- Insight

- Thursday 20th January 2022

A year in the life of the Common Domain Model

They say a week is a long time in politics, well twelve months is certainly a long time in the life of the Common Domain Model.

As we enter 2022 it is a good time to reflect on how the Common Domain Model has developed over the last 12 months and the opportunities ahead in what will be a busy year for its development.

In CDM myth #1 Leo explained how REGnosys has been acting as technology partner to the industry’s trade associations in the development of the CDM. REGnosys do not develop the CDM in isolation though. The engineering approach for development of the model is based on three principles:

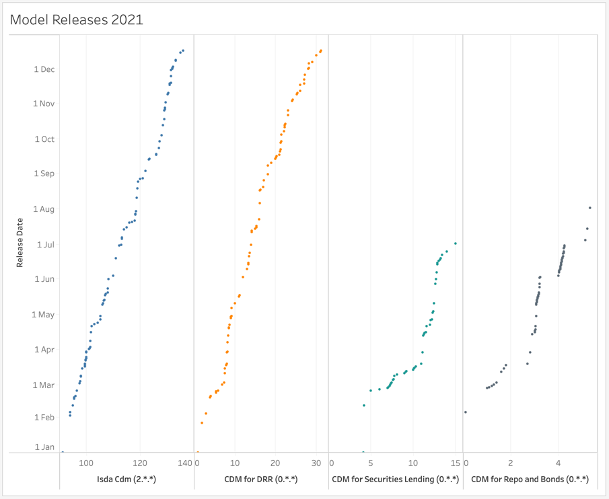

260 releases and over 50 individual contributors across all instances of the CDM

1. Community Driven – the model is extended based on the needs of the community, with priorities identified and agreed through committees and working groups run by the trade associations and their members.

2. Functional – the CDM is not just a logical data model, it contains a functional representation of common industry process to promote standardisation and interoperability.

3. Test Driven – Rosetta allows to create and manipulate data from the business domain developing “test scenarios” on which the model can be tested in real time. This critical element is core to ensuring that as the model develops users have visibility on the scenarios the model covers and that results remain consistent.

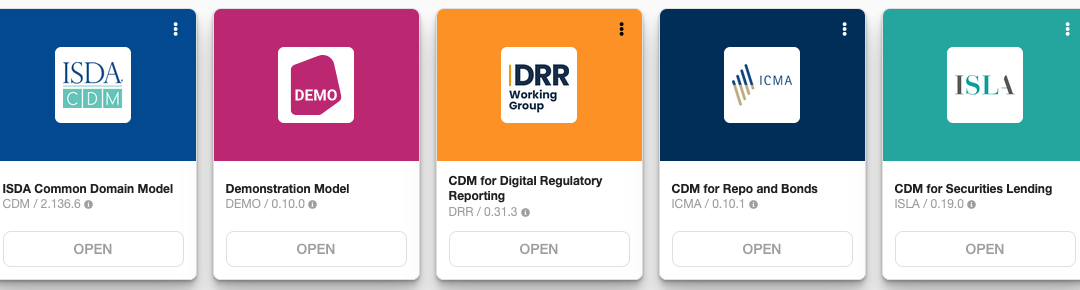

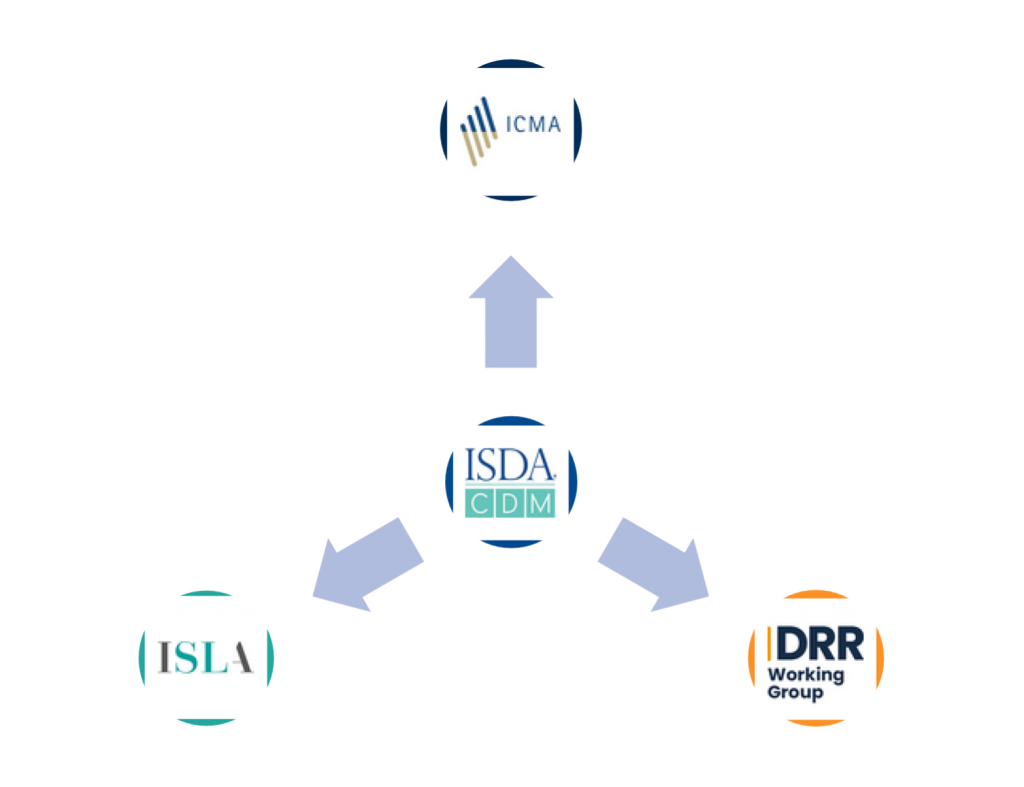

At the top of the article the picture shows a number of different CDM models. This does not mean though that there are competing standards already. Since mid 2020 the ISDA CDM has been extended by a number of initiatives. Each of these extended models inherits all of the content from the core model, and benefits each time the core model is updated. But the extended models are also able to add, or prototype, additional concepts which may not be ready for the core model, or may better sit as additional content in their own domain.

1. The CDM for Securities Lending – At the start of 2021 two versions of the CDM existed. The ISDA CDM, covering Derivatives, and the CDM for Securities Lending, which was in proof of concept stage under the guidance of ISLA. During the course of 2021 this model was further developed to cover a set of key goals defined by the ISLA CDM Working Group. Following completion of the proof of concept stage in mid 2021 all additional content in the CDM for Securities Lending was contributed into the ISDA CDM creating a single model covering both Derivatives and Securities Lending.

2. The CDM for Repo and Bonds – starting in Spring 2021 the ISDA CDM was extended again by ICMA to design a model to use by repo market participants transacting in various repo structures and current guided by the ICMA CDM Steering Committee. The first phase of this work completed in mid 2021 with a virtual event showcasing the content that had been developed.

3. The CDM for Digital Regulatory Reporting – also starting in 2021 industry participants have been collaborating to develop a functional representation of regulatory reporting rules for the next wave of rules being published, in particular CFTC Rewrite and EMIR Refit, with a core design component being representation of the CPMI-IOSCO Critical Data Elements. ISDA and JWG have both been guiding development in this space through a set of co-ordinated programmes.

On top of all of the above the ISDA CDM has continued to develop at pace guided by the ISDA Architecture Review Committee and with additional contributions through FINOS. Just some of the highlights include:

- The Product Model has been extended to support Commodities, Basket swaps and Inflation products, and rationalised to better represent price and quantity, cashflows and settlement terms;

- The 2021 ISDA definitions have been supported as a digital standard from inception through extension of the floating rate data structure and functional model;

- The Event Model has been refactored to support a composable design approach, and the Rosetta DSL has been extended to support a greater set of functional operators;

- The CDM is now integrated into ISDA Create linking the Legal Agreement Model to other operational processes defined in the CDM.

The pace of change and level of collaboration demonstrates the agile, community-driven development principles of the CDM

Referring back to one of the core development principles the CDM is a community driven project. Rosetta has been designed from inception as a community collaboration tool allowing free access to core functionality used to develop the CDM. 2021 proved to be a breakthrough year for this approach with model contributions being made by over fifty different individuals. This level of contribution demonstrates that the development principles are being delivered on by the industry, and the support for the project across a wide range of institutions.

The development of the CDM is managed based on the principles of agile project management, this means that model releases happen frequently allowing the model to develop very quickly. As can be seen from the graph below all four models developed at a fast pace during 2021 with frequent model releases occurring. Users of and contributors to the CDM therefore do not need to wait long for new features to be added. A release is normally just round the corner containing new content. Across all four models there were a remarkable 267 releases completed, more than one a week.

After such an exciting year in 2021 what is in store for the coming year? The key word has to be collaboration. Whether it is across the Trade Associations, with members and industry participants, regulators, or through open source initiatives driven by FINOS, the CDM is at the heart of digital transformation of the financial services industry. Implementations of the model are increasing in pace and each one brings the opportunity to broaden the scope and usage of the model creating greater collaboration opportunities. REGnosys has been pleased to work with our clients over the last year on these changes, and are looking forward to another exciting year ahead.

Please get in touch with REGnosys to see how we can help you benefit from the CDM.